On any given day in a community or long-term care (LTC) pharmacy, there are dozens of outside factors that can affect your business and its profits. The industry is in constant flux, and that uncertainty led to the closure of more than 600 retail pharmacies in 2017. Independents closed 67 locations; chains decreased by 138; grocery store pharmacies lost 169 and mass pharmacies shrank by 252.1

Mergers, shrinking reimbursements, federal regulations and, of course, politics, will continue to affect the pharmacy industry in 2018. According to the The National Community Pharmacists Association (NCPA®), the National Association of Chain Drug Stores (NACDS) and QS/1’s market analysts, some of the top issues on the horizon for this year include:

- Reimbursements, especially direct and indirect remuneration (DIR) fees.

- The National Council for Prescription Drug Programs (NCPDP) SCRIPT Standard.2

- How to utilize patient health information to provide more efficient and effective treatment.3

Reimbursements

Pharmacies continue to fight for fair and timely reimbursement models. DIR fees continue to be the most significant profit hit on pharmacy reimbursements, and pharmacies continue to seek ways to predict and mitigate these fees. There are regulatory changes to watch, including a proposed change to regulations on “any willing pharmacy” to participate in networks, which could benefit pharmacies in 2019 regarding Medicare Part D plans.4

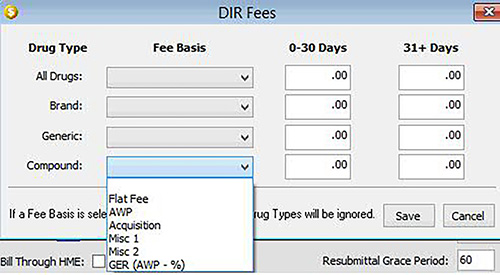

QS/1’s focus in 2018, as it is every year, is to ensure your success. To that end, in Service Pack 19.1.26, which is set for release this summer, we plan to include a DIR fee estimator that will allow you to account for DIR fees per individual price plans using four different methods: flat fee, average wholesale price (AWP), acquisition or generic equivalent rate (GER). These options can be set up by category, such as all, brand, generic or compound, as well as segmented by monthly versus extended-days’ supply. The enhancement will also allow you to set up a profit warning alert at the time of fill that will alert you to a potential negative margin so you can determine how to proceed. The estimated DIR fee will also be added as a Print Option on daily reports as well as in transaction-based programs for custom reporting.

We are also working to ensure we offer services that will enable your pharmacy to fill specialty medications and exploring new technologies, such as pharmacogenomics via drug-gene interaction notifications.

Update to SCRIPT Standard

The Centers for Medicare & Medicaid Services (CMS) is proposing an update to the current electronic prescribing standard for the Part D e-Prescribing Program, the NCPDP SCRIPT Standard. New versions of standards are created when standard-setting organizations, like NCPDP, review their existing standards, ballot and recommend changes and adopt new versions of existing standards. NCPDP has recommended that CMS adopt the latest version of the NCPDP SCRIPT Standard, Version 2017071. The prior version (Version 10.6) was adopted November 1, 2013.

There is currently a CMS mandate to implement the new SCRIPT Standard by January 1, 2020. This includes electronic prescriptions, refill requests and some additional message types that are new for this standard.5 The standard would affect our SharpRx, NRx, RxCare Plus® and PrimeCare customers. QS/1’s systems will be ready before the deadline to ensure you are compliant.

SharpRx

In addition to federal regulations, QS/1 will continue to add features and functionality to our next-generation pharmacy management system, SharpRx, in 2018. Making the system more robust is a top priority, and we are currently working to include, among other things, interfaces, nursing home features and clinical tools, such as medication therapy management (MTM) and lab values.

In addition, we are preparing to release our SharpPOS system and take the integration between it and SharpRx to the next level. By making both products work and feel like one, they will increase productivity and save time in the pharmacy.

Data Integration

A third trend encompasses several developments related to patients’ healthcare information. A major issue is how to better share digital data to provide more efficient, effective treatment. A smooth information flow among healthcare providers is crucial to coordinating patient care, the lack of which costs the industry tens of billions of dollars a year in wasteful spending, such as duplication of tests, as well as negative experiences and results for patients.6

QS/1 recognizes the need for better sharing of patient information between pharmacists and other healthcare providers, and it recently received Level 2 certification for the Pharmacist eCare Plan, a program that standardizes documentation of patient information and facilitates its exchange between healthcare providers and pharmacists. The goal is to advance care coordination, improve patient outcomes and reduce overall healthcare costs.

Making patient data fully portable and under the patient’s own control takes this concept even further, and it is receiving increasing attention. The government’s recently announced MyHealthEData initiative is an example. This initiative’s goal is to give patients easy access to and control over their health records to use with any software application they choose. This requires that software developers, healthcare providers and other patient data generators agree to use technical specifications for interoperable technology, including application programming interfaces (APIs).

The growth of smart machines, whether wearables like Fitbit or artificial intelligence applications like IBM Watson Health, also has implications for data integration. In just one example, the real-time data generated by health wearables could help with medication adherence, which remains a major obstacle to better healthcare outcomes. But how best to integrate and use this data remains an open effort – just another illustration of the role that data sharing will play in patient care moving forward.

Sources:

1 Long, Doug. “Pharmaceutical Trends, Issues, & Forecasts.” NACDS, 5 Feb. 2018, Ft. Lauderdale, FL, Marriott

2, 4 NCPA. “Community Pharmacy Owners Rank 2018 Policy Priorities.” NCPA, 8 Jan. 2018, www.ncpanet.org

3, 6 Fong, David J., Pharm.D. “Pharmacy Trends for 2018.” 18 Dec. 2017. Accessed 26 Mar. 2018. www.wolterskluwercdi.com/blog/pharmacy-trends-2018/

5 “CMS Proposes Policy Changes and Updates for Medicare Advantage and the Prescription Drug Benefit Program for Contract Year 2019.” CMS, 16 Nov. 2017. www.cms.gov/Newsroom/MediaReleaseDatabase/Fact-sheets/2017-Fact-Sheet-items/2017-11-16.html

Comments (0)